|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

How to Refinance Your Rental Property Effectively and ProfitablyRefinancing your rental property can be a strategic move to enhance your investment portfolio. It involves replacing your existing mortgage with a new one, often to secure better terms or tap into your property's equity. Understanding the Basics of RefinancingBefore diving into refinancing, it's crucial to grasp the basic concepts involved. Reasons to Refinance

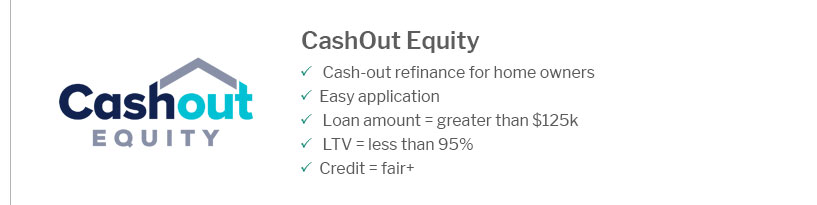

Potential RisksWhile refinancing can offer many benefits, it's not without risks. Make sure to consider potential drawbacks such as closing costs and changes in interest rates. Steps to Refinance Your Rental PropertyRefinancing involves several key steps that you'll need to follow carefully. Assess Your Financial SituationStart by evaluating your current financial health. Ensure your credit score is strong and your debt-to-income ratio is favorable. Research LendersCompare offers from various lenders. It's wise to look into the best companies to refinance your home to find competitive rates and terms. Submit Your Application

Maximizing Benefits from RefinancingOnce you've refinanced, there are strategies to maximize your benefits. Reinvest SavingsUse the money saved from lower monthly payments to reinvest in other properties or pay off debts. Monitor Market TrendsStay informed about market conditions to make informed decisions about when to refinance again if needed. Frequently Asked QuestionsWhat are the typical costs involved in refinancing a rental property?Refinancing costs can include appraisal fees, loan origination fees, and closing costs, which typically range from 2% to 5% of the loan amount. How does refinancing affect my taxes?The interest on a refinanced loan for a rental property is tax-deductible, similar to the original mortgage. However, it's advisable to consult a tax advisor for personalized advice. Is refinancing a rental property different from a primary residence?Yes, refinancing a rental property typically involves stricter credit requirements and may have higher interest rates compared to a primary residence. In conclusion, refinancing your rental property can be a beneficial financial strategy when done with careful consideration and planning. For those seeking the best rates, exploring options like the best 15 year home refinance rates can be a great start. https://www.bankrate.com/mortgages/how-to-refinance-a-house-renting-out/

Knowing when to refinance your rental property comes down to factors like your current mortgage interest rate and remaining term years. https://www.stessa.com/blog/refinance-rental-property/

In this article, we'll explain five reasons why investors refinance rental property, explain the loan documents and refinancing requirements that mortgage ... https://www.quickenloans.com/learn/refinance-investment-property

Property owners typically refinance to get a lower mortgage rate, shorten or lengthen their loan term or tap into home equity.

|

|---|